Penticton's Real Estate Market Shows Signs of Recovery Despite Housing Crisis

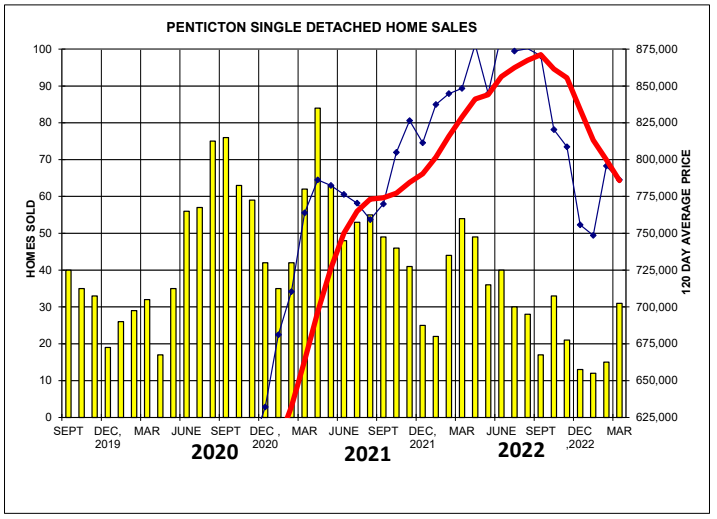

The number of home sales in Penticton in March was greater than January and February combined with 31 homes trading hands, which is almost exactly where we would expect to be in our NORMAL maket condition. What is different this time however is the incredible demand for homes. While buyers sit back and wait to see if there will be a better time to buy, home sellers are in no rush to list their homes knowing prices have already started to rebound. The average home sale price in Penticton at the end of March was $786,263, down only 7.31% from March or 2022. While prices are down from the peak last summer, they have already started to recover as interest rates are holding and the demand is still strong. This demand is unlikely to change much until we build our way out of this housing crisis, unfortunately. As Interest rates start to ease later this year, prices will once again start to edge upwards.

Need to Sell Your Home Fast For Top Dollar?

You can call our office anytime at 250-492-1011 for a FREE Quick Over-the-Phone Home Evaluation. As it’s the name implies this is a NO cost, NO obligation way of learning what your home could sell for in today’s market.

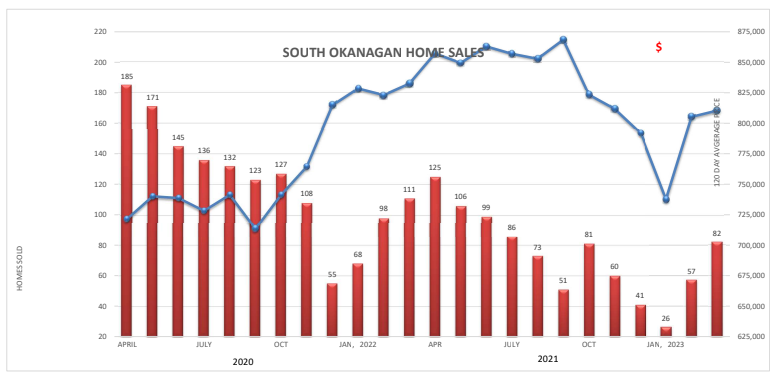

Home sales across the entire South Okanagan have shown a marked increase over last month and the average sale price is UP to $835,361, an increase of 0.35% over the same time last year. This number is skewed slightly as there have been a couple large sales recorded questionably by our MLS system as we continue to work the kinks out of merging with the Kelowna and Central Okanagan MLS.

Looking To Retire In Penticton?

You can call our office anytime at 250-492-1011 or Click Here to view available Waterfront Homes In Penticton

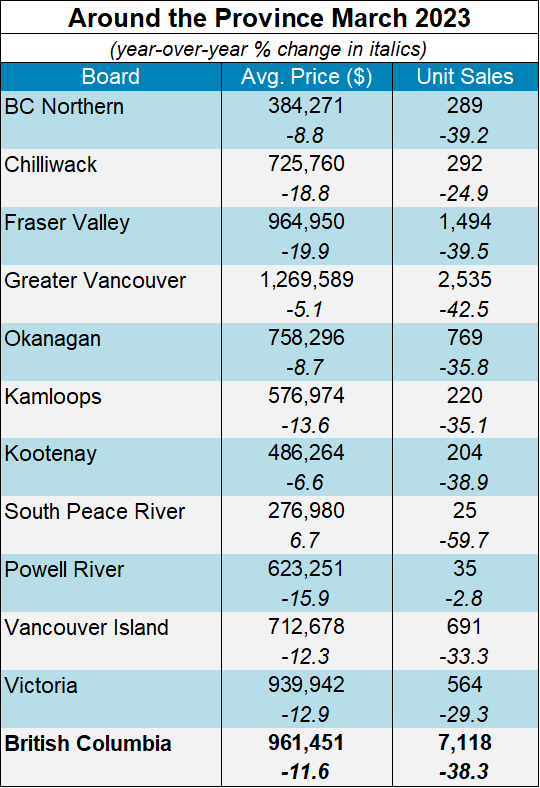

Home sales recorded over Canadian MLS® Systems posted a 2.3% increase from January to February 2023. Gains were led by the Greater Toronto Area (GTA) and Greater Vancouver. (Chart A) The actual (not seasonally adjusted) number of transactions in February 2023 came in 40% below an incredibly strong month of February in 2022. The February 2023 sales figure was comparable to what was seen for that month in 2018 and 2019. “February’s data contained the potential of a more robust market to come, but to repeat the bottom line from last month, we won’t know what the 2023 market has in store until the spring,” said Jill Oudil, Chair of CREA. “While we’re not seeing it in the sales or listings data just yet, I would expect homeowners are getting properties ready for the market and prospective buyers are getting mortgage pre-approvals. Make sure to contact your local REALTOR® for information and guidance about buying or selling a property,” continued Oudil. “The similarities between 2023 and the recovery year of 2019 continued to emerge in February, with sales up, the market tightening, and month-over-month price declines getting smaller,” said Shaun Cathcart, CREA’s Senior Economist. “But the biggest similarity was a sharp drop in seasonally adjusted new listings. Future sellers, many of whom will also be buyers, are likely biding their time until the optimum time to list and buy something else. For most, that’s in the spring. Will buyers jump off the fence to snap homes up in 2023 once they finally start to hit the market? They did in 2019.”

The number of newly listed homes dropped 7.9% on a month-over-month basis in February, led by double-digit declines in several large markets, particularly in Ontario. With new listings falling considerably and sales moving higher in February, the sales-to-new listings ratio jumped to 58.4%, the tightest since last April. The long-term average for this measure is 55.1%. There were 4.1 months of inventory on a national basis at the end of February 2023, down from 4.2 months at the end of January. It was the first time the measure has shown any sign of tightening since the fall of 2021. It’s also a full month below its long-term average. The Aggregate Composite MLS® Home Price Index (HPI) was down 1.1% on a month-overmonth basis in February 2023, only about half the decline recorded the month before and the smallest month-over-month drop since last March. The Aggregate Composite MLS® HPI now sits 15.8% below its peak level, reached in February 2022. (Chart B) Looking across the country, prices are down from peak levels by more than they are nationally in most parts of Ontario and a few parts of British Columbia, and down by less elsewhere. While prices have softened to some degree almost everywhere, Calgary, Regina, Saskatoon, and St. John’s stand out as markets where home prices are barely off their peaks. Prices began to stabilize last fall in the Maritimes. Some markets in Ontario seem to be doing the same now. The actual (not seasonally adjusted) national average home price was $662,437 in February 2023, down 18.9% from the alltime record in February 2022 but up more than $50,000 from its January level resulting from outsized sales increases in the GTA and Greater Vancouver, two of Canada’s most active and expensive housing markets. Excluding these two markets from the calculation cut almost $135,000 from the national average price in February 2023.

In Summary

- Home sales in Penticton increased in March with 31 homes sold, which is almost where the market would typically be in a normal condition

- There is an incredible demand for homes and home sellers are not rushing to list their properties, expecting prices to rebound

- The average home sale price in Penticton at the end of March was $786,263, down only 7.31% from March 2022, but prices have already started to recover

- Home sales across the entire South Okanagan have also shown an increase, with the average sale price at $835,361, an increase of 0.35% from last year

- Home sales recorded over Canadian MLS® Systems increased by 2.3% from January to February 2023, led by Greater Toronto Area (GTA) and Greater Vancouver

- February 2023 sales figure was 40% below February 2022, comparable to 2018 and 2019 figures

- Number of newly listed homes dropped 7.9% on a month-over-month basis in February, led by double-digit declines in several large markets, particularly in Ontario

- Sales-to-new listings ratio jumped to 58.4%, the tightest since last April, with 4.1 months of inventory on a national basis at the end of February 2023

- Aggregate Composite MLS® Home Price Index (HPI) was down 1.1% on a month-over-month basis in February 2023, only about half the decline recorded the month before and the smallest month-over-month drop since last March

- Actual (not seasonally adjusted) national average home price was $662,437 in February 2023, down 18.9% from the all-time record in February 2022, but up more than $50,000 from its January level, resulting from outsized sales increases in the GTA and Greater Vancouver.

VIP Buyers Get Priority Access

Become a VIP Buyer & Get Priority Access to the Best Properties BEFORE Other Buyers. Call 250-492-1011 or Click Here to get started.

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !